This website is called How To Go Independent. The natural question that I probably should follow that is what does that actually mean? What does it mean to “be independent?”

After six and a half years of having my own practice, and about six years before that pondering having my own practice, I have an understanding in my own head and with the people I talk to regularly what independent means. But a couple things have come up in the last week that have reminded me that anytime you're trying to communicate something that you're very familiar with, you need to do the best to start at the beginning.

This isn't to insult anyone who's already independent -who already has understanding of what that term tends to mean in our industry. This is more to make sure that anyone who's not independent and doesn’t know exactly what that might entail understands it and get comfortable with the term. If nothing else to make sure when we’re talking to each other if we say that word, we can say "what exactly do you mean by independent?" And then know what questions to ask to clarify those sorts of things.

So the first thing that popped up was actually just looking at my day to day. This is a Monday as I write this and I was looking at my schedule. It’s about 1:20 in the afternoon, and today happens to be a busier than usual Monday for me.

At 6:30 in the morning, I went to volunteer at a charity golf tournament to shuttle people back and forth from the parking lot to the clubhouse. It happens to be a rainy day here at the Dallas area, so it was raining and cold and I was volunteering at an event that one of our key employees is very involved in and has a passion for. So several of us were helping out, which is great. So I did that for about two and a half hours.

Then at 10:00 this morning, one of my partners and I had a phone call with a potential strategic partnership. So I did that remotely with my partner. He concluded the call on the way to a client appointment and I did the call from my office. Then I grabbed a bite to eat and then had a quick phone call with a home office person from our broker dealer firm about an issue I’m trying to get resolved.

Then here in a bit I’m gonna go pick up my son from his preschool, run him to my wife. Logistically for the family that was helpful today, so I’ll be doing that then I’ll get back to work after picking up some computer equipment from some of our staff at 2:30 or so, and then I’ll get back to office to work.

Feel the need to sneak in or out of the office? You might not be independent.

So I gave you that kind of very uninteresting agenda for the day mostly because what I had to do and will have to do to get that kind of schedule setup approved or reviewed and think about the people that would care about what I’m doing on any given day other than my clients or they need something specifically.

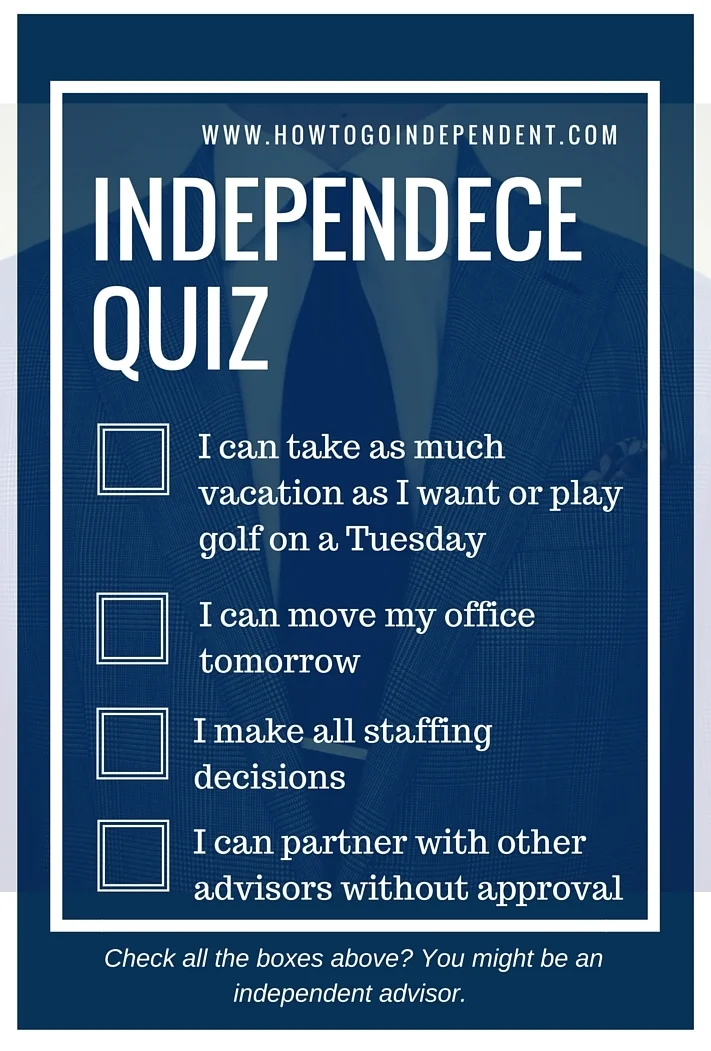

There is no one who’s monitoring my whereabouts or I need to get those sort of activities approved. So I guess that to me is one of the hallmarks of being independent. Who’s setting your agenda? Who’s setting your calendar? Who are you getting approval from? Is there such as thing as vacation?

If you have to get vacation, you're probably not independent. That would be one determinant. If you're gonna feel guilty you have to disguise or somehow obfuscate your schedule where you spend your time, then you're probably not independent.

I know a lot of my colleagues or at least some of them, in the wirehouse world, day to day certainly no one is monitoring our whereabouts every minute of every day, but I certainly saw situations where there seem to be a lot of appointments happening at 3:05 or 3:15 or 3:30 PM. Looking back it appears to me that established advisors, once the market was closed, sort of unofficially ended the day but they weren't able to make that official because that's just not the culture of the firm they worked in.

So if you are having to play games like that, you’re not independent. So that kind of hit me this morning but the idea was in my head idea last week because in talking to one of my associate advisors who’s talking to several of his colleagues and former colleagues about life on this side of the employee world looks like, we realized there's this expectation or thought that somehow independent means you're out there building something from absolute scratch. For example, payroll, setting up legal entities, figuring out which money managers to use, building relationships individually, or who knows what other misconceptions.

But the idea is the word independence might kind of take, if you think about the United States of America, becoming independent was fighting a war, creating a new constitution, a new country, basically starting from scratch instead of the established/known constraints of the English king. Obviously even though it was not ideal for me lots of people said, well "it’s kind of the devil we know and we shouldn't try to start over because....', excuse my ignorance of the details of that historical argument but you get the idea.

So being independent, let’s me start there, is not starting a new country. It's more like taking a constitution and operating under it. Just picking a new constitution. In that way it's more like current day emigrating from England to the United States. Same language, maybe a different side of the road to drive, different accent, but there are gonna be rules at play. You’re not starting from scratch.

So that broadly said what does it mean to go independent? Or to be independent more specifically? The two or three big things I look at are: number one, where do you office? In most large brand name firms, obviously there are only handful of locations that you can office from.

If you live in Dallas-Fort Worth for example, and picked any one of the three or four biggest-name, largest-headcount, largest asset wirehouse firms, other than Edward Jones, those firms have handful of offices in the metropolitan area. It’s a decent sized metro area so if you wanna live out in the rural or very ex-urban areas, you gotta have quite a commute to get to your desk too then often, talk on the phone, email people, read things on the computer. One thing I've come to find, I would argue that anything that you need to do in our industry except meet with clients face to face, anything else, any other function or at least core function can be done remotely.

So that doesn’t mean you have to work from home, out on your farm. But if you want to work 10 miles away, or 10 yards away in a Starbucks downstairs, you can do it with a laptop, cellphone and a relatively light amount of coordination in your cloud-based software.

But the bottom line is who chooses where you office? If you’re in a metro area, you love the office and you want to switch to another office, can you do that without approval? If not, you're definitely not independent. So that's one huge flexibility I find is independent advisors can craft their own office space solution whether that's working from the corner of their master bedroom or having an opulent space for their small practice that maybe really shouldn't spend the money on, but they decide they want to, then they're welcome to. So deciding how and where you office is a big mark in my mind if you're independent or not.

Who makes the hiring and firing decisions in your practice?

Another huge determinant on what that term means to me is who decides who you hire and let go if necessary? Who determines your staffing? For example if you have to have a 1.3 million in revenue to have your own assistant, besides the fact that seems ridiculous to me from just a business case, then you are not independent. I don't care if that number’s 100,000 or 200,000 or 800,000 or a million or 3 million. If you don't get to choose who works for you in terms of when you hire them, how much you pay them, if you share them with other people, other people you share the assistants with, then you're probably not independent.

So being independent means you do not have to incur the cost of an assistant if you are happy or willing and able to do your own paperwork, which I know a lot of folks who are.

It may not be the most productive business use of an advisor’s time, but there are lots of cases where I see that the goal is not to grow even necessarily a lot. It’s to have a high quality life from hours-worked standpoint, stress level. And they just rather have the simplicity of knowing if someone's screwed up it was their owns fault from a paperwork standpoint.

That might limit the upside but they’re fine with that because of their own personal reasons or they just haven't got to the point where you're willing to make investment. When you’re actually writing the check yourself, it's a little different than when your firm is taking the money and using your payout to pay the assistant, it just feels different and that's natural. But who, how, when, how much, all those questions around staffing is a very big determinant if you're independent or not.

And the other critical factor I see is who do you partner with and how? So I’ve kind of alluded to in several episodes, I have several existing relationships with other advisors through either the advisor network that we've built, or advisors who eventually when they retire, probably be in the position to buyout their practice,

Those relationships were all developed organically without any interference from any manager, supervisor, or higher up. The only supervision that’s involved in being independent is around the actual running the business in terms of regulations either industry or firm, regulations, rules and policies. Never around who's gonna partner with who and how you're gonna split the revenue. All that is negotiated individually.

That came up in my recent conversation with my partner Brandon Day when he mentioned how we had come to agree with other partner as well. That was all self-driven, self-regulated. And if we want to change something, we discuss that and it’s up to us. Our broker dealer firm wants no part of that. In fact if we try to involve them they’ll tell us that that’s not their deal. That's not what they do. They also do not provide office space and they do not provide assistants. So they do not want to get in the middle of office space, assistants, partnerships between advisors, relationships between advisor and assistants, relationships between supervising OSJ, as we call it, and advisor.

So it does feel like the wild wild west to some people in terms of not having structure but then again you have organizations like our advisor network and others like it at different firms that have sprung up to provide some structure.

So those are the three major categories that I think determine whether or not you’re independent and what it means to say “we are independent.” It means we get to pick where we office, who we employ, how much we pay them, etc., and who we can partner with and how. So that’s a fairly short list.

What being independent does not mean from my perspective and experience is it doesn’t mean you’re gonna be completely starting from scratch on your own with everything. And I forget that advisors who had firms who give them day to day operational independence, for example Edward Jones is great in that you have your own office. There’s no one there to look over your shoulder. That’s one of the benefits of that model. It appealed to me when I got there, it appealed to me when I left. I think it’s a smart way to do business to allow each advisor to grow the business the way they see fit, give them full autonomy. There’s study after study and survey after survey that says that's one way to increase people's satisfaction with their jobs.

So if you’re an employee but you feel like you're not, if you feel like you have full control of your day then that’s a great way to retain employees which I think is what Edward Jones has done for the most part. And I used that example because one, they have a different office structure, and two, I have pretty familiar with it having spent three years there.

So being independent does not mean you have to start from scratch. What you do have to do is make educated decisions on what you want to do for office space, which again takes more work than being told where to go or having very few options. That's a given. But it’s really not the hurdle that I think many of you might think it is. There are 3-4 easy obvious kinds of offices you can look at. There’s executive suites, there’s sharing a small office space with another advisor, there's plugging into a bigger network and the benefits that might entail. There are people who are willing and able to help you solve that problem if you don’t want to figure it out to yourself.

You know, the trade office, it might cost you a little of that huge payout increase you now have. You might spend that on someone making that easy for you, either that through a network of advisors who charge you a small portion of your revenue or an executive suite which is fairly expensive per square feet but it's also very simple. So you're not gonna have to negotiate your own office space lease for the rest of your life. And if you do, it’ll be because you want to. And you can get pretty good terms if you want to sign the long term lease on your own office space. That's another option.

The staffing issue - same idea. There are people out there that will provide support at least at our broker dealer and my network we’ve built that a lot of our firms that look like us have done the same at our broker dealer and others. If you were to go pure RIA, which I can talk about in another episode, the custodian will have resources to help you get up and running. You’ll have business partners in your custodian, your broker dealer and/or your OSJ network and a lot of resources to help you get started.

We all realize in going independent, there's a huge barrier to making the leap. Getting reestablished quickly is a huge priority for not only you but for whoever is in business with you because if we take a small cut of your revenue, we don’t get paid until you start generating revenue. There’s a great alignment of incentives to finding the right staff. Certainly lots of people find people they know and train them eventually to become their assistants. There are all kinds of ways to solve that but it doesn’t mean you have to start from scratch and interview a hundred people, do background checks and do this and that. That is not necessarily what independence means.

And there’s nothing saying you have to have an assistant either. So that's a big part of being independent, is make that decision but again it doesn't have to be a massive undertaking. Each one of these pieces is important and might take some time but with the right planning it’s not overwhelming at all. And there's lots of help out there.

If you’re the type of person who likes to plug and play nature of a wirehouse, maybe the decision isn't so much “which printer do I buy?” but rather “which network am I gonna find to plug into that will give me great value for telling me the best resources to use, so I get to work helping my clients and not worry about office space and how to find an assistant, or what kind of laptop to buy." They've already got these sort of best practices or “hey this is a good solution, here's our standard recommendations” and you can go from there. So there’s all kinds of in between models of how to bridge this idea of being completely on your own and being plugged in as an employee where you have very little flexibility.

And then the next part is the partnership or who-do-you-work-with aspect. Again, you don't even have to come and to play but if you come across someone that you personally know or develop a relationship with, you’re welcome to explore whatever fit there is- sharing resources, coaching each other, holding each other accountable, kind of having accountability partner in terms of. "I'm trying to do this with my business or that with my business.”

If you need someone for succession plan and to make sure if something happens to you, your family gets paid the value of your business. We see people get together all the time that don’t know each other overly well but come to know each other well because they have similar goal that I need someone to be the beneficiary of their business so if something happens then that asset they’ve built, the value is passed on to their family. So again there's a wide range of options in getting help. Some of them might cost a lot more than is worth at least if you compared if you do it yourself.

So I recommend people comparing, at least have a ballpark of what it would like cost wise to do something themselves and then get a quote, compare a couple options for plugging into a group or having more of a plug and play approach and see what the difference is. Just like we outsource our lawn care or oil changes. Oftentimes you're gonna find that the learning curve, time, energy and money that you spend to master these things right away on your own is not worth what you pay in terms of shared revenue to get things set up and running.

And then the good news is even if you decide you do want to do everything yourself at some point, there are solutions out there that will allow you to get up and running as an independent advisor with some support but they’re not locking you in for any significant period of time so that after 6 months a year, 2 years, whatever the time frame, you can have your business up and running and make sure your clients are taken care of with a change and then revisit the vendors, the arrangements you have and make sure you're happy with them. If you decide you’d rather create your own, you're free to do so as long as you have gotten to a relationship with someone who, that was clear upfront, you’ve got that and writing if necessary. If there is any question about whether someone would allow you to do that then you probably shouldn't be dealing with that network or provider in the first place but generally speaking you're gonna be free to do with what you think is best for you, with whatever vendor you're working with.

So that was a summary of some of the things I think it means, the ways I think it means to be independent and what it doesn’t mean. So if you have any questions, you know, is it independent or not?

If that were a game show, that would probably not be very interesting to many people. But if you have any questions for that hypothetical game show, Is it independent?

Then feel free to email me at sean@indyFA.com or leave us a review at over on my itunes podcast.